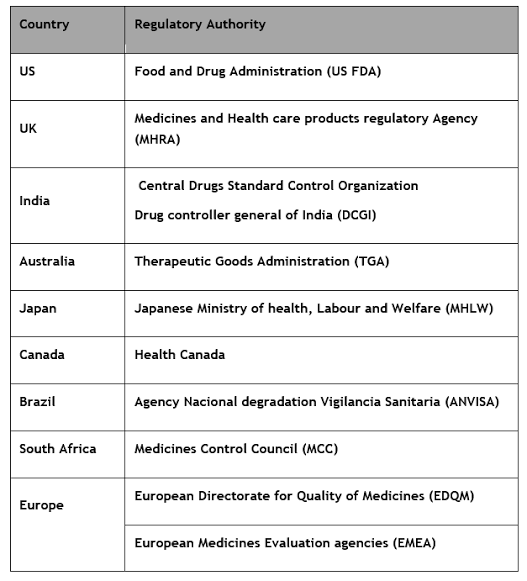

Regulatory authorities

Intro

- Independent bodies est to set stds in a specific field of activity & enforce those stds, Ex—RBI, SEBI, CCI, NPPA, TRAI, IBBI

- Art 53(3) authorises Parliament to confer by law regulatory functions to authorities.

- Functions—

- Regulations and guides

- Review and assessment

- Licensing & Inspection

- Corrective actions & Enforcement.

- To support Dev of market of allocated jurisdiction.

Origin

- LPG—Rolling back of state + ↑ role of market—Advent of Regulatory regimes for arm’s length superintendence of specific sectors + Act as ‘nurturer’ & ‘parent’ of its sector—Played a constructive role

Need for Independent Regulators

- To Prevent Market Failure—For efficient allocation of resources to maximise social welfare

- Can occur bcz of natural monopolies or asymmetric information, externalities (-ve—Putting ‘Pigovian Tax’, Clean Energy Cess are ex of regulation)

- Boost investor confidence (By ensuring free & fair market)–Incentivise Pvt investment by giving them functional autonomy & shielding them from interference

- Ensuring orderly & sustained growth of the sector, attracting private investment, enhancing consumer protection

- To check anti-competitive practices like cartelization

- To Protect & promote Public interest

- BIS Set quality & safety stds for various products

- RBI— In tackling liquidity crisis & Mgt of NPAs

Issues

- Politicisation, Selection of non- experts, Inefficient review mechanism

- Their Recommendations r rarely implemented

- Overlapping jurisdiction—

- Env—CPCB & NGT

- Controversy b/w SEBI & IRDAI over ULIP

- Edu—AICTE & UGC

- Adm Incoherence—Unlike other countries (US have Adm Procedure Act, 1946)—India does not have an overarching Adm statute in India.

- Lack of A/C—Less Parliamentary supervision

- Structural Weakness, Not aligned to global standards

- Outdated Legal Framework—Telecom sector still governed by Indian Telegraph Act, 1885

- Lacks of overarching policy that specify sector wise roles & R/S of the regulators– impinges on their independence & conflicting responsibilities.

Way

- ↑ their Independence & autonomy (Functional & financial) with corresponding A/C & T/P

- Adopt best practice like “Regulatory Impact Assessments” (OECD)

- Single Umbrella regulator–Mooted by Mistry committee, Raghuram Rajan committee, FSLRC

- 2nd ARC–

- Parliamentary oversight of regulators be ensured through respective DRSCs.

- Periodic evaluation of regulators by external agencies

- Involve citizens, professional org in regulation activities.

- Need for uniformity in structure of Regulators (Terms of App, tenure & removal etc)

- FSLRC recommendations–

- Financial independence through independent sourcing of finances such as fees.

- Merge Regulators like SEBI, IRDA & PFRDA

- Est a comprehensive and enforceable code of conduct.’

Conclusion

Need for an empowered regulatory regime to make sectors of economy robust & smoothly mitigate economic impacts of Covid -19.

![Abhishek Saraf [UPSC Topper 2019] Biography, Age, Family, Marksheet, Optional & More 117319406_133530055082669_3985285308971443267_n.jpg](https://iasbio.com/wp-content/uploads/2020/11/117319406_133530055082669_3985285308971443267_n.jpg)