What’s Disinvestment?

Disinvestment can be defined as the action of an organisation (or government) selling or liquidating an asset or subsidiary. Govt target for FY18 is 72500cr.

Various Ways of disinvestment-

• Sale of minority stake through IPO or Offer for Sale

• Multiple disinvestments through Exchange Traded Funds in stock markets. Bharat 22 ETF Fund

• Strategic Sale

It started after 1991 economic policy and was suggested by Rangarajan committee in 1993 and Disinvestment Commission in 1996.

Disinvestment plan of Govt. of India-

• ministry name changed to DIPAM

• Alternate Mechanism by CCEA where a minister’s panel will decide on strategic sale of PSU

• Govt to come up with strategic disinvestment policy. This comes after more than a decade when privatisation of PSU was ended

• Govt accepts NITI Aayog recommendation of strategic sale in 22 PSU up to 51%

• National Investment Fund- It was created in 2005. All the proceeds from the disinvestment of Centre Public Sector Enterprises were to be channelized in this fund.

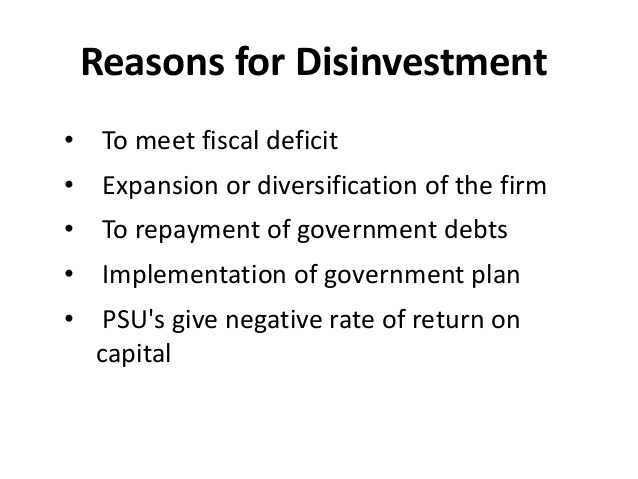

Advantages of disinvestment –

• Loss making PSU are a costly appendage

• Trade unionism, inefficient workers and bureaucratic red tapism hamper growth

• Private sector injects efficiency and technology

• It ensures competition increases in market as private players increase

• Fund raising for the government and release of stuck capital

Disadvantages of disinvestment-

• Loss of jobs and lesser government control

• Private monopolies and cartels may be created

• Undervaluation of assets while selling gets less money

• Due to lack of private demand, govt asks LIC to buy shares

• Corruption and delays in disinvestment process. FY17 target of 56000 cr never achieved.

![UPSC CSE Topper Mains Answer [Gaurav Agarwal] word-image-10753-1](https://iasbio.com/wp-content/uploads/2023/06/word-image-10753-1-150x150.png)