Steel

• Geography

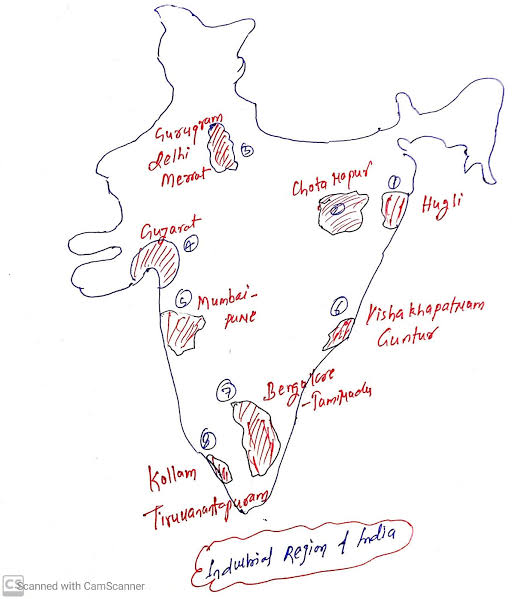

Iron and steel

Earlier Ruhr coalfields were famous. Then iron ore was exhausted

US (Pittsburg (rust bowl) -> Alabama), Russia (Pittsburg, Moscow), Germany, India, China (Shanghai), Japan.

• National Steel Policy

○ Domestic Preference in Govt Procurment

§ Importers will also be given preference if they add at least 15% value to it

§ Waiver for vertain kinds of steel

○ Output – 300 MTA by 2030

§ Currently 100 MTA

○ Increasing the Per Capita availability of steel by 2.5 times from 60kg to 160kg by 2030

§ World average is 200kg now

○ Reducing Dependence on Imported Coking Coal ( makes up about 85% now – to 50%)

○ Steel Projects close to Coast under Sagarmala

• India currently 3rd largest steel producer

○ Production- around 100 million tonnes

○ China is largest producer with 800 million tonnes

○ Target- 300 million tonnes by 2025- will become 2nd largest

• Concern

○ RBI classified debt worth 2 lakh crore with Debt at Risk

§ 1.1 lakh crore (>50%) in Steel

§ Up from 20k crore in 2012

○ Sales have declined by >10%

○ Imprt

§ China

□ Showed 70% increase in 2014-15 fiscal

□ More worry because of Yuan’s devaluation

□ Highlighted in London G 20

§ Othrers dumping because of Chinese slowdown

• Effects

○ Y, Employment

○ Most of the steel industries in backward regions of Jharkhand, Orissa, Chattisgarh

○ Usefulness in Construction ( Housing for All), Shipbuilding, Transport, Consumer goods

○ Domino effect on other industries- Banking, Mining, Ferro Alloy

• Steps taken

○ Rise in basic cusom duties, Anti-Dumping Duty,CVD, Provisional Safeguard Duty, rise in Minimum Import Prices

○ Institution for Steel Development and Growth ( INSDAG)

• SAIL with 1/4th of India’s production is augmenting its capacity rapidly

• Interest to add also by private parties like TATA ,Essar, JSW, Mittal

•

Paper

– Inputs

○ Wood Pulp

○ High Electricity

○ Water consumption higher

○ Good Transport Network

○ Labour, EODB

– International

○ Hence, bulk located in the developed countries where wood pulp are available in plenty and electricity supply is at plenty

○ Like USA, Canada

– India

○ Found near the sources of Wood Pulp with good Electricity esp Hydro which fill the purpose of water along with electricity

○ Located near Western Ghats, Terai, NE areas, Eastern Ghats

– Issues

○ Scarcity of Wood Pulp due to inadequate prevalence of Agro Forestry

○ Digitisation

○ India’s Recyc;ing rate of Paper is very low, aggreavting the rawa material issue

○ Environmentally polluting industry – Red Category

○ Competitiors – China

○ India depended on US for pulp. But, recently ,subsidy witdhrawn in US, has added to the costs

○ EODB issues

Sugar

• Geography

○ Location

§ Weight loosing industry

□ So located near the source of Sugar

□ Need to be crushed within 24 hours of harvesting

§ Hence, it began in the regions of Bihar and UP

§ Other factors – Labour intensive, Transport

○ Recent shift

§ South important

§ Overall – Maharashtra > UP > Bihar > South

○ Advantages of Southern Areas over Northern

i. Uniform temperature. North faces loo and fog

ii. Tropical climate and moderating influence of ocean-> High sucrose content

iii. Longer crushing season in South

iv. Other factors

1) Irrigation facilities of Kaveri basin

2) Migrant workers form Bengal, Odisha are there

3) Chennai and Kochi ports-> export

• Total Production wrt world

• Problems

○ Oversupply of sugar in the market

○ Prices have fallen below the cost incurred

○ Also unable to repay to farmers- farmers at loss

• Reasons

○ High procurement price from farmers

○ Centre keeps a high FRP (Fair & Remunerative Price )

○ States like UP too add a SAP (State Advised Price )

○ Reserve Area Norm- The mills have to buy sugarcane from all the farmers in the area at the administered price

○ As farmers are getting assured prices, they are expanding production

○ 20% Jute bag packing norm- further increases input costs

■ Done away with

• Solutions

○ Remove state administered prices so that market can work efficiently

○ Ethanol Blending

■ Currently this is stuck due to differences in prices/quality between sugar companies & oil companies

■ This needs to be sorted out at the earliest

■ Benefit

□ Oil Import bill

□ Less emission

□ Sugar industry

□ Export in future

○ Some steps have already been taken in the last 2 years

■ export Quota

■ Production surplus

■ Govt paying dues to farmers at interest free loans of 6k crore directly to farmers’ accounts

■ Price of ethanol has been increased

Handloom

• Strengths

○ Unique design

○ Link with culture

○ Completely environment friendly

○ Employment to rural and women

○ Low capital required

• National Handlloms Day

○ 7th August

■ The D Day 😛

○ To mark the 100th anniversary of Swadeshi Movement in 1905

• Other govt initiatives

○ Centre has developed India Handloom Brand

■ Works like a GI tag

■ Assures genuine quality like purity, proper texture, yarn , etc

○ Propmotion of enterprenuers in the weaving families

■ Concessional loans

○ Use of tech

■ Online transaction under PMJDY

■ Marketing via e-comerce

■ Direct interaction to customers via digital platform

○ Setting up of Common Faccility Centres ( CFC) in each block

■ Will have facilities such as storage, office space, training facilities

TEXTILE

• Scenario

○ Dominated by women

• shifting to Vietnam & Bangladesh & China :

○ Situation

■ China

• 1/4th of India in 1990

• Now X2 times India

■ Bangladesh

• exported 1/4th of India in 1990. (same as China)

• Today 50% more than India

■ Similar trend in Vietnam

○ Why textile

■ Labour intensive

• 25 times more than steel

■ Employment to women

■ Foot loose industry

■ Jeans – SE Asia

■ Backward linkage with agr

○ Reasons

■ Duty

□ Duty on Bangladesh, Vietnam lower than India

® Europe – exemptions under International Multifibre Agreement

□ TPP will only aggravate the situation

■ Indian textile dominated by small firms (organised only 6% in cotton) which as upto 15 times less productive than formal (Eco Survey 15-16)

□ Not completely bad though

□ The informalisation of textile industry also associated with spatial spread and greater women employment

■ Threads

□ India – mostly cotton

□ Ban, Vietnam- synthetic fibres

■ Labour cost : While labour cost in India is low in campare to China, it is higher than in Vietnam or Bangladesh thereby lossing cmpetitiveness in global market.

■ 4) Logistic Infrastructure : congestion at major ports entry/exit, non-completion of economic corridors have result in increase in average dwell time.

■ Appreciation

■ 7) Low level of expenditure on marketing and branding of products.

• BIG RISK

○ WTO Norms

■ Once, A country crosses 1000$ GNI per capita and a Market Share of 3.25% , then it has to do phase out subsidies within 8 years

■ For India, this limit is 2018

■ FTA could be impacted and competitiveness could delcine further

• Steps required

○ TECHNICAL Textiles Promotion

■ See April 35

○ Subsidy Issue

■ Move from Product Based Subsidy to Production based Subsidy

□ Say Cheap Power

■ Call for extension

○ FTA with UK, etc

○ GST – Low rates

○ See steps in Economic Policy – TUDF, EPF, Relocation, MSME

• Steps

○ Integrated Skill Development Scheme ( ISDS) –

■ Skill development

○ Textile Parks

○ Package

■ Tax subsidies of upto 5%

○ ATUFS

■ Ameneded Tehcnology Upgradation Fund Scheme

○ PM rojgaar Protsahan Yojana

○ POWERTEX – to boost Powerloom industry – Has seen a reduction in the share to about 20% ( Verify datat from Geo notes )

SILK

– See Oct 17, 27 and highlight / note the important points

Cotton

Despite a bumber harvest and a rapid increase in production over the last decade due to technology impovements, the cotton industry in India faces various problems.

1. Low international demand

a. EU- 60% of the market slowing

b. China slowing

2. Bangladesh, Pak have zero duty access to US, Europe

3. Removal from the Focus Market Scheme ( FTP) : Cotton producers no longer enjoy the benefit of reduced freight and transportation costs, raising prices and hence making the productive less competitive internationally.

4. Competition with cheaper synthetic fibres.

5. Structural

a. Low yield:half of that of the USA

b. Rain fed

c. Deterioration of soil, groundwater, leaching

d. Outdated Machinery

e. Unorganised textile sector in India

i. 90% in unorganised as compared to 20% at independence

ii. No economies of scale

f. EODB

Steps in past

1. Market intervention: CCI is mandated to procure cotton from the farmers if Market prices fall below MSP.

a. But MSP to farmers is loss to exporters

b. Inflation

c. Need rather for DBT based subsidy

d. As China does

e. Other disadvantages of MSP- distortion, reduces credibility, area limited

2. Power subsidy to cotton farmers.

3. Tech upgradation scheme

a. Announced in 1999

b. Brought in 3 lakh crore investment till now

c. Is exppirirng in 2017

d. Need to renew this

Other solution required

1. DBT subsidy

2. Exploring new markets

3. Improvement in agriculture

4. Elboration required

ALUMINIUM

Location factors for Alumium industry:

1)Proximity to ore of bauxite which forms the major raw material

2)Availability of good transport networks to get other raw materials like

Coal , coke, caustic soda, lime, cryolite, aluminum fluoride, calcium fluoride, anthracite and soda ash

3)Presence of power/electricity which forms major share of the input cost

4)Traditional factors like good supply of labor

Hence one of worlds largest plant in korba where both bauxite and coal in plenty

Problems of Aluminum industry:

1)Non-availbility of bauxite as an outcome of delayed environmental clearances leading to shut down e.g. Vedanta Group’s Lanjigarh Alumina refinery in Orissa closed the operations

2)Reduced global demand and prices as a result of sub-prime crisis and Euro Crisis

3)Sharp rise in imports of aluminium

4)Export of bauxite to other countries creating deficit for the domestic producers

5)Increased competition from substitutes like steel, titanium, copper, glass and plastic

6)Pressure to reduce Greenhouse Gases and Perfluorcarbons (PFCs) in wake of climate change

7)Non-availability of power at cheap rates (cross subsidy surcharge) , strike and labor unrests

8) Domestic issues : Production in India is facing obstacles such as resistance by the Dongria kondh tribes in Niyamgiri hills and environment clearances.

Potential of Aluminum industry:

1)‘Make in India’ campaign would spur up development of industries in India where Alumina can be a raw material

2)Bauxite reserves in other countries have depleted while India still holds a good amount

3)Requirement of Aluminum in infrastructural development that will be boosted as a result of renewable technologies like Solar and wind

Jute Industry → West Bengal (India)

Raw material • 90% of Jute is cultivated in the Kolkata hinterland

• Jute is the only crop that can withstand flooding of this region

Energy • From coal → Raniganj and Jharia coal mines

Water • Jute processing require large quantity of water for washing, bleaching & retting

• Easily available from Hoogly river

Labour • Jute-processing is labour intensive

• Cheap labour available from Bihar, Odisha, W Bengal

Capital • Kolkata always had good banking-finance facilities

• Initially it was the capital of British India, Hence Jute mills flourished the most here

See Here

See Agriculture and Livestock – Esp Fisheries

PHARMA

COIR

• See May 28

• Link it to AGRI

• Coir Udyami Yojana – Credit

• Coir Vikar Yojana

SAND MINING

• See Shankar – 89

Oil Palm

• It is the highest –yielding oil crop and needs only fraction of the area used to grow other oilseeds.

• China, Indonesia and India alone use 41% of the palm oil traded worldwide.

• Import bill of edible oil is expected to touch $ 15 billion in 2016-17. It is third largest, next to only crude oil and gold.

• The palm oil plant is grown in a nursery for 12-18 months before it is planted in the field where it bears fruit 30 months later and has an economic life of 20-30 years

• Indonesia and Malaysia are the two major palm oil producers globally, producing nearly 85 per cent of the global output.

• Tropical humid climates near equator are most suitable. Hence there is a protest against clearing of rain forests in Indonesia and Malaysia

• AP (86% of domestic production)> Kerala> Karnataka.

Ecological concerns

• Tropical forests in Indonesia

• Shifting cultivation of NE will be replaced by monoculture. IT will reduce biodiversity

• It requires chemical inputs also.

Govt. Steps

• National Mission on Oilseeds and Oil Palm (NMOOP) to bring additional 1.25 lakh hectares under oil palm through area expansion approach in the states including utilization of wastelands.

• 100% FDI in oil palm plantation under automatic route.

• In 2015, government has announced a package of ₹10,000 crore over three years, which is intended to support farmers until the trees begin to yield (it takes three to five years for the palm tree to start yielding fruit

• There is an attempt to expand it in NE.

Way Forward

• Declare oil palm as a plantation crop to move it out of the Land Ceiling Act. This deters large investments form big corporates

• Irrigation requirement: Palm requires humid weather throughout the year. The harsh Indian summer impacts both crop development and yield. In hot summer months, the recommended irrigation is 300 litres per plant per day. This limits the regions where this crop can be grown.

• Close proximity between farms and processing mills is a must. The fresh fruit bunches should be processed within 24 hours of harvest to obtain good quality oil.

• There’s the lack of trained and experienced farmers who can successfully make money out of this crop. As a solution, the government has allowed 100 per cent FDI in the sector.

• Current import duties are not supportive of domestic producers. Hence these should be altered.

• Separate Oil Palm development board to boost the industry and farmers.

e-Commerce

• Currently valued at 20 billion $

• Expected to reach 100 billion $ by 2020, according to ASSOCHAM

• Largest FDI in 2015

• Currently around 2 crore people buy online

• Benefits

○ Consumers-

■ Full choice, home delivery as & when required

■ Heavy competition in the e-Commerce has pushed prices down

○ MSME sector

■ is benefited who constitute majority of the sellers

■ In particular, govt signed an MoU with Flipkart to sent Indian Handicrafts

○ Great Equaliser

■ Any seller, rich or poor alike can use it

■ Has created a true National Market

■ Was endorsed by WTO – who are planning to set up e-commerce regimes in LDCs and link up MSMEs with them

○ Logistics industry which has grown manifold

■ Because this is manpower intensive – creates job opportunities

○ Overall, 7 lakh direct jobs & millions indirect exected

• FDI

○ Currently, 100 % allowed in B2B

○ No FDI in B2C

○ Benefits of FDI

○ Japanese SOft Bank invested 500 million $ in snapdeal

• Depends on

○ expansion of broadband- BharatNet

○ Allowing FDI so that consumers can benefit more than a few Indian companies

○ Investment in transport, warehouse , data infrastructure

• Care Needed at the Same Time

○ Snapdeal selling drugs online

○ “Fraudulent” Flipkart advertisements in Dussehra, 2014

○ Regulator needed for the sector

○ Pop shops

• Elaboration required

![UPSC CSE Topper Mains Answer [Part 2] images-2023-06-17T192027.770](https://iasbio.com/wp-content/uploads/2023/06/images-2023-06-17T192027.770-150x150.jpeg)

![UPSC CSE Topper Mains Answer [Gaurav Agarwal] word-image-10753-1](https://iasbio.com/wp-content/uploads/2023/06/word-image-10753-1-150x150.png)