• The Financial Action Task Force (FATF) is the global group that keeps an eye on money laundering and funding for terrorism. It was set up in 1989 after a meeting of the G-7 in Paris.FATF is an organisation made up of governments that works to set standards and encourage the effective use of legal, regulatory, and operational means to fight money laundering, financing of terrorism, and other threats to the integrity of the international financial system.The FATF is actually a group that makes policy and works with states to change national laws and regulations in these areas.

Table of Contents

Objective:

At first, the goal was to look into and come up with ways to stop people from laundering money.

• In 2001, after the 9/11 attacks on the United States, the FATF added attempts to stop terrorists from getting money.

• In April 2012, it added work to stop the spread of Weapons of Mass Destruction (WMD) by stopping the money that pays for them.

Members and Observers of FATF:

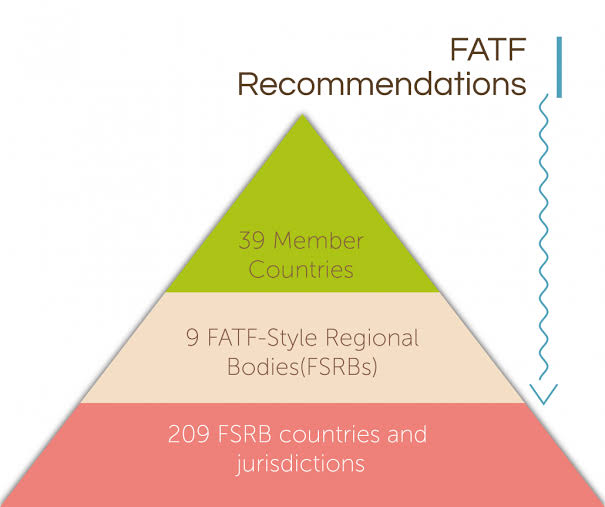

• Members: As of today, it has 39 members who represent most of the world’s big financial centres.

o The European Commission and the Gulf Cooperation Council are the only two regional groups among the 39 members.

FATF members include Argentina, Australia, Austria, Belgium, Brazil, Canada, China, Denmark, Finland, France, Germany, Greece, Hong Kong (China), Iceland, India, Ireland, Israel, Italy, Japan, Republic of Korea, Luxembourg, Malaysia, Mexico, Netherlands, New Zealand, Norway, Portugal, Russia, Saudi Arabia, Singapore, South Africa, Spain, Sweden, Switzerland, Türkiye, the UK, and the US.

• India and FATF: India joined FATF in 2006 as a “observer,” and in 2010 it became a full member.

India is also a member of the Asia Pacific Group (APG) and the Eurasian Group (EAG), which are groups of countries in the same area.

• Countries that keep an eye on FATF: Only Indonesia does this.

Some important groups that have observer status with the FATF are: the Asian Development Bank (ADB), the International Monetary Fund (IMF), the International Organisation of Securities Commissions (IOSCO), Interpol, the Organisation for Economic Co-operation and Development (OECD), the United Nations Office on Drugs and Crime (UNODC), the United Nations Counter-Terrorism Committee Executive Directorate (UNCTED), the World Bank, and the World Customs Organisation (WCO).

FATF Secretariat

• The FATF Secretariat is in the Paris office of the OECD.

• The FATF Secretariat and other services are paid for by members’ contributions to the FATF’s yearly budget. • The Secretariat helps the FATF members and global network do their important work.

The FATF Sessions

The FATF Plenary is the group that makes decisions and meets three times a year.

FATF President:

The FATF President is a top official who is chosen from among the FATF members by the FATF Plenary.

He or she calls meetings of the FATF Plenary and the Steering Group and leads them. He or she is also in charge of the FATF Secretariat.

He or she is the main FATF spokesman and represents the FATF to the outside world.

• The President’s term starts on July 1 and ends on June 30 of the second year after he or she takes office.

FATF’s Grey and Black Lists

• The FATF Plenary meets three times a year, in February, June, and October, to review the “Mutual Evaluation Reports” (MERs) of the countries it looks at.

If a country’s AML/CFT system seems to have big problems, it is put on a list of “jurisdictions under increased monitoring” (also called a “grey list”), and if it doesn’t address FATF’s concerns, it is put on a list of “high-risk jurisdictions” (also called a “black list”).

o “Anti-Money Laundering/Combating the Financing of Terrorism” is what “AML/CFT” stands for.

To get off the “grey list,” a country has to do what the FATF suggests. For example, it might have to take away the property of people who are part of terrorist groups.

o If the FATF is happy with how things are going, the country is taken off the list.

• Grey List: The Grey List has countries on it that are thought to be safe places for funding terrorism and hiding money.

It’s a warning that the country might be added to the ban.

• Black List: Non-Cooperative Countries or Territories (NCCTs) that help fund terror and hide money are on the Black List.

Iran, North Korea, and Myanmar are the three countries on the black list right now.

Myanmar was just added to the list because of what the military government did after the coup in 2021.

• If a country is on a FATF list, it is exposed to the following: • Economic sanctions from FATF-affiliated financial institutions (like the IMF, World Bank, ADB, etc.)

It is hard to get loans from these countries and banking institutions.

International trade decreases International boycott

India, Pakistan and FATF GreyListing:

• Recently, Pakistan was taken off the grey list by the FATF, which praised “Pakistan’s significant progress.”

• After four years, the country was taken off the list. It was first put on the list in 2008, then taken off in 2009. From 2012 to 2015, before it was put back on the list in 2018, it was watched more closely.

• India agreed to take Pakistan off the list because Pakistan had shown “documentary evidence” of what it had done to stop terrorists who were on the list.

• When Pakistan was taken off the grey list, it got a boost to its image and a clean bill of health from the rest of the world when it came to funding terrorists.

Issues Associated with FATF

• Difficulty in internal coordination is one of the problems with adopting and implementing FATF codes in member states. Another problem is that some countries don’t have enough resources to do the job.

Not enough tools to run the business

Evaluate how hard it is to put FATF guidelines into place

• One of the problems with putting in place new tools for AML/CFT is that people don’t understand the threats and risks of ML/TF (Money Laundering/Terror Funding).

Not being able to find, evaluate, and deal with ML/FT risks well enough.

Traditional risk assessment tools don’t let you look at a lot of data at once. This makes it harder to find connections and draw conclusions that will give you a clearer picture of the risks.

• Other things that make ML/TF more likely to happen are: The lack of coordination between international groups and the huge amount of laws that have been made.

Weaknesses in national regulatory systems; Unauthorised transfers and movements of assets across national borders; High costs for private non-state actors (financial and non-financial organisations) to implement the risk approach.

What Can Be Done to Make FATF Stronger?

• Risk Assessment: A risk-based approach should be the foundation of a good AML/CFT system and is important for managing risks in the right way. FATF Standards can only be used effectively if people know and understand risks well enough to be able to reduce and deal with them in a proportional way.

• Sharing data: Being able to gather and process more data, as well as share it with other stakeholders, could help a lot in the fight against ML/TF.

• How modern technology is used: Machine learning and other tools based on artificial intelligence that allow for faster and more accurate data analysis in real time may be the answer to the problems listed above.

![UPSC CSE Topper Mains Answer [Gaurav Agarwal] word-image-10753-1](https://iasbio.com/wp-content/uploads/2023/06/word-image-10753-1-150x150.png)